can you look up a tax exempt certificate

The name of the buyer matches your customer name. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases that remain taxable and how to effectively administer these tax provisions.

Form 1023-EZ Streamlined Application for Recognition of Tax-Exemption Under Section 501c3 of the Internal Revenue Code.

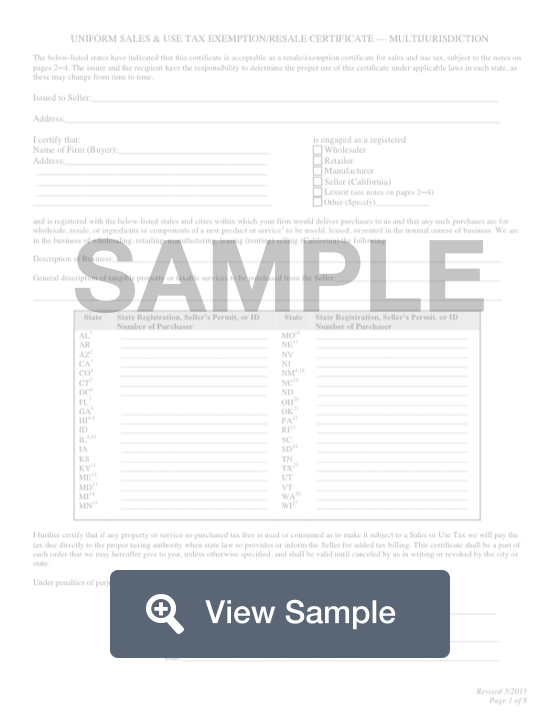

. Choose Search and you will be brought to a list of organizations. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Complete the Type of Business Section.

The online search tool allows you to search for an organizations tax exempt status and filings in the following data bases. Business Incentives Reporting and Building Materials Exemption Certification. There are a number of.

Enter your name or the name of your business. Form 990-N e-Postcard Pub. The seller fraudulently fails to collect the sales or use tax.

To apply for tax-exempt status the following must happen. All information on the certificate is completed. You may also contact the Internal Revenue Service at 877829-5500 and ask that they verify the.

Although you cannot search by tax exempt number you can search by the organization and location. If you cannot remember whether you registered your business using your own name or your business name conduct your search in multiple ways selecting the option that allows you to search for a name that includes. Automatic Revocation of Exemption List.

Look for a line that says Streamlined Application for Recognition of Exemption Under. To get started click on the Verify a Permit License or Account Now. In order to access a copy of your original 1023 EZ form you will need to log in to your account click on My Account in the upper right-hand corner of the screen and then click on My Forms This page will list any forms submitted through your account.

The purpose of the business must be expressed in full detail. Sales tax exemption certificates may also be issued and accepted electronically in York and. Information for Claiming Disaster Relief.

Exemptions Certificates and Credits. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. Automatic Revocation of Exemption List.

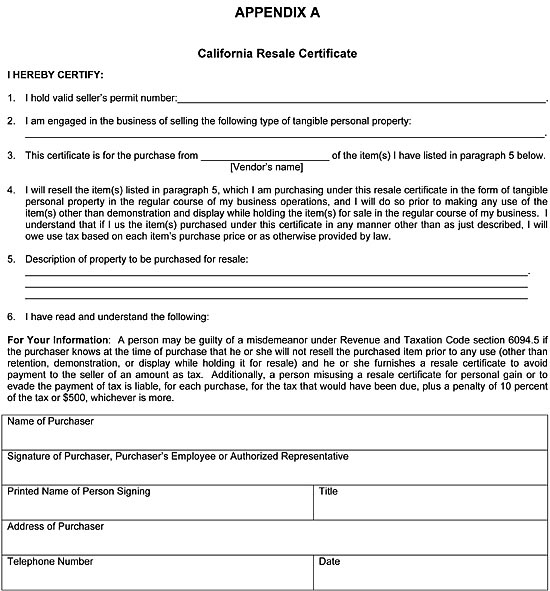

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt. If a seller accepts an unsigned and undated certificate the liability for the sales tax will likely be on the seller. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses.

Online Verification of Maryland Tax Account Numbers. A copy of the articles of incorporation must be submitted. Production Related Tangible Personal Property Is Now Included within the Manufacturing Machinery and Equipment Exemption.

This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file. A seller is not relieved of its liability to collect and remit the applicable Wisconsin sales or use tax on a sale to a purchaser if any of the following apply. You can verify that the organization is a tax exempt non-profit organization.

Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries. Additional Information for new users. When payment is made with the personal funds of an authorized representative the purchase is subject to tax even if the representative is subsequently.

The seller accepts an exemption certificate. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax.

Form 990 Series Returns. An EIN or Employee Identification Number must be obtained. Here are several steps a company should take to validate a certificate.

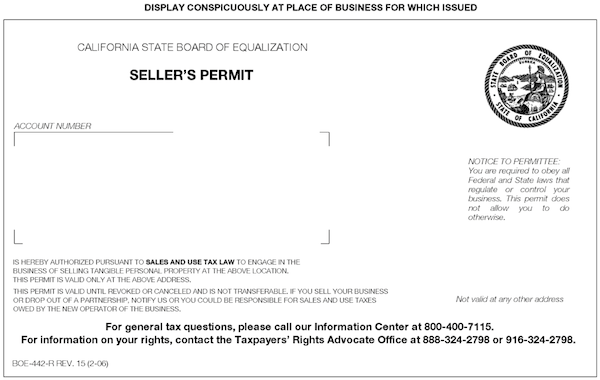

About the Tax Exempt Organization Search Tool. The IRS has four separate applications organizations can use to apply for tax-exempt status. On the next page use the dropdown menu to select Sellers permit.

A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. The form is dated and signed. You can also search for information about an organizations tax-exempt status and filings.

Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office. Illinois Small Business Jobs Creation Tax Credits. Payment for the purchase must be made with the governmental entitys funds.

Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each. Provide a copy of the Florida Consumers Certificate of Exemption to the selling dealer to make tax exempt purchases or leases in Florida. Form 990 Series Returns.

Form 990-N e-Postcard Pub. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. The form youll use depends on the type of organization.

This is a mandatory step regardless of whether the entity has employees or not. How to Apply for Tax-Exempt Status. Choose the option that enables you to search by the business name or the owners name.

Common Errors Identified in Tax Audits. You can then enter the permit Identification Number you want to verify and click the Search button. The tool will output the status of the resale certificate within a few seconds.

In some cases you must also have a valid Certificate of Authority to use an exemption certificate. The Department of Revenue recently redesigned the certificates the Department issues. The seller solicits the purchaser to claim an unlawful exemption.

Sales Use Tax Credit Inquiry Instructions

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

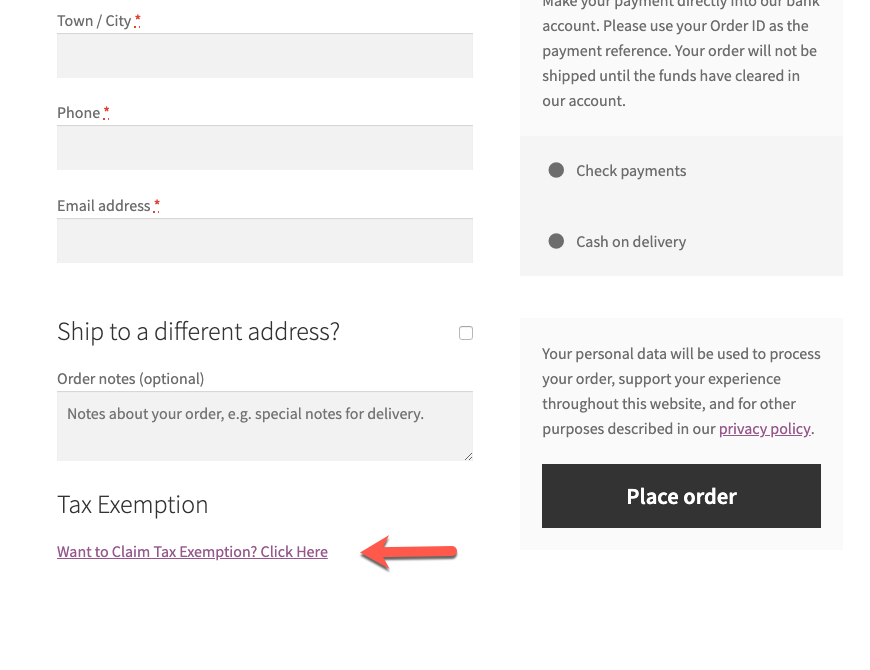

Woocommerce Tax Exempt Customer Role Exemption Plugin

Woocommerce Tax Exempt Customer Role Exemption Plugin

Printable California Sales Tax Exemption Certificates

How Do I Know If I Am Exempt From Federal Withholding

Tax Exempt Meaning Examples Organizations How It Works

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Resale Certificate How To Verify Taxjar

Sales Use Tax Credit Inquiry Instructions

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition