nh meals tax form

2017 Meals. THE STATE OF NEW HAMPSHIRE General Instructions for Completing the Financial Affidavit Form NHJB-2065-F A.

Payment on your FUTA form Line 13.

. Decide on what kind of eSignature to create. Questions concerning amended or. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year.

Youll then get one report with details on each specific meals tax restaurant tax requirement that youll need to fulfill. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the New Hampshire sales tax you need the appropriate New Hampshire sales tax exemption certificate before you can begin making tax-free purchases. 78-A6 Imposition of Tax.

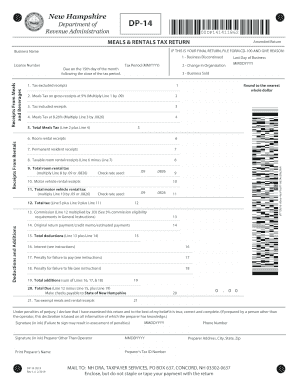

TOTAL TAX DUE - The total of lines 11 and 12 is the total tax due to the State of NH. Follow the step-by-step instructions below to eSign your nh dp14. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

The notice of tax means the date the board of tax and land appeals BTLA determines the last tax. File this form at least 30-days prior to the start of business or the expiration date of the existing license. There are three variants.

This page explains how to make tax-free purchases in New Hampshire and lists 0 New Hampshire sales tax exemption forms. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603 230-5920. If you need additional forms you may access them on our website at wwwrevenuenhgov you may copy those found in this booklet or call the Forms Line at 603 230-5001.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Get Started at LicenseSuite. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. A Meals served or furnished on or off premises by a qualified educational organization or an agent under contract with such organization to students regularly attending the organization in conjunction with educational purposes shall not be subject to tax. After that your nh meals and rooms tax form is ready.

2018 Meals. Department of Agriculture Office of the Assistant Secretary for Civil Rights 1400 Independence Avenue SW Washington DC. Create your eSignature and click Ok.

2021 Meals. Submit your completed form or letter to USDA by. 2022 Meals.

A tax of 85 percent of the rent is imposed upon each occupancy. B Meals served or furnished by a qualified educational organization or an agent under contract with such organization to. File this application with the municipality by the deadline see below.

Application forms can be obtained from the Board of Tax and Land Appeals 603-271-2578. We last updated New Hampshire DP-14 Bklt in April 2022 from the New Hampshire Department of Revenue Administration. Food prepared on the premises as defined in Rev 70116 which could reasonably be perceived as competing with an eating establishment that is primarily in the restaurant business is taxable.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Exact tax amount may vary for different items. 2020 Meals.

We also offer services where we can handle all the paperwork for you making obtaining a New Hampshire Meals Tax Restaurant Tax quick and easy. Meals And Rooms rentals Tax - Nh Department Of Revenue Mak86w - Waterfront Vacation Rental With Indoor Pool The State Of New Hampshire Judicial Branch. NH imposes a 9 percent tax on meals and rooms with a 3 percent vendor discount.

How to Get a New Hampshire Meals Tax Restaurant Tax. Example line 11 X UI Tax Rate 35 49000 line 12 X AC Tax Rate 02 2800 line 13 TOTAL TAX DUE 51800 if under 100 no payment due Line 14. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

WHERE TO FILE Mail to. Department of Administrative Services Division of Personnel 54 Regional Drive 5 Concord NH 03301 Phone. Accordingly New Hampshire is listed as NA with footnote 11.

Technical information release provides immediate information regarding tax laws focused physical areas of grocery stores convenient stores and gas stations. INTEREST ON TAX DUE - Interest is due on the tax if not paid in a timely manner. 2015 Meals.

2016 Meals. 2019 Meals. NH DRA PO Box 454 Concord NH 03302-0454.

There is also a 85 tax on car rentals. File this form at least 30-days prior to the start of business or the expiration date of the existing license. A Four cents for a charge between 36 and 37 inclusive.

When this form is needed - You must fill out and file this form. NH DRA PO Box 454 Concord NH 03302-0454. New Hampshire is one of the few states with no statewide sales tax.

There are however several specific taxes levied on particular services or. To request a copy of the complaint form call 866 632-9992. We will update this page with a new version of the form for 2023 as soon as it is made available by the.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Twenty-eight states allow vendor discounts most with caps of 25 to 500 per month. B Five cents for a charge between 38 and 50 inclusive.

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the equivalent of federal Form 1120 and unlike. Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service. File an application form or letter requesting an abatement with the Board of Tax and Land Appeals State Office Park South 107 Pleasant Street Concord New Hampshire 03301.

More about the New Hampshire DP-14 Bklt. Select the document you want to sign and click Upload. Meals Rentals Tax Return you must file a paper return and your Meals Rentals Tax Operators License must be returned to the Department.

A tax is imposed on taxable meals based upon the charge therefor as follows. A typed drawn or uploaded signature.

Incorporate In New Hampshire Do Business The Right Way

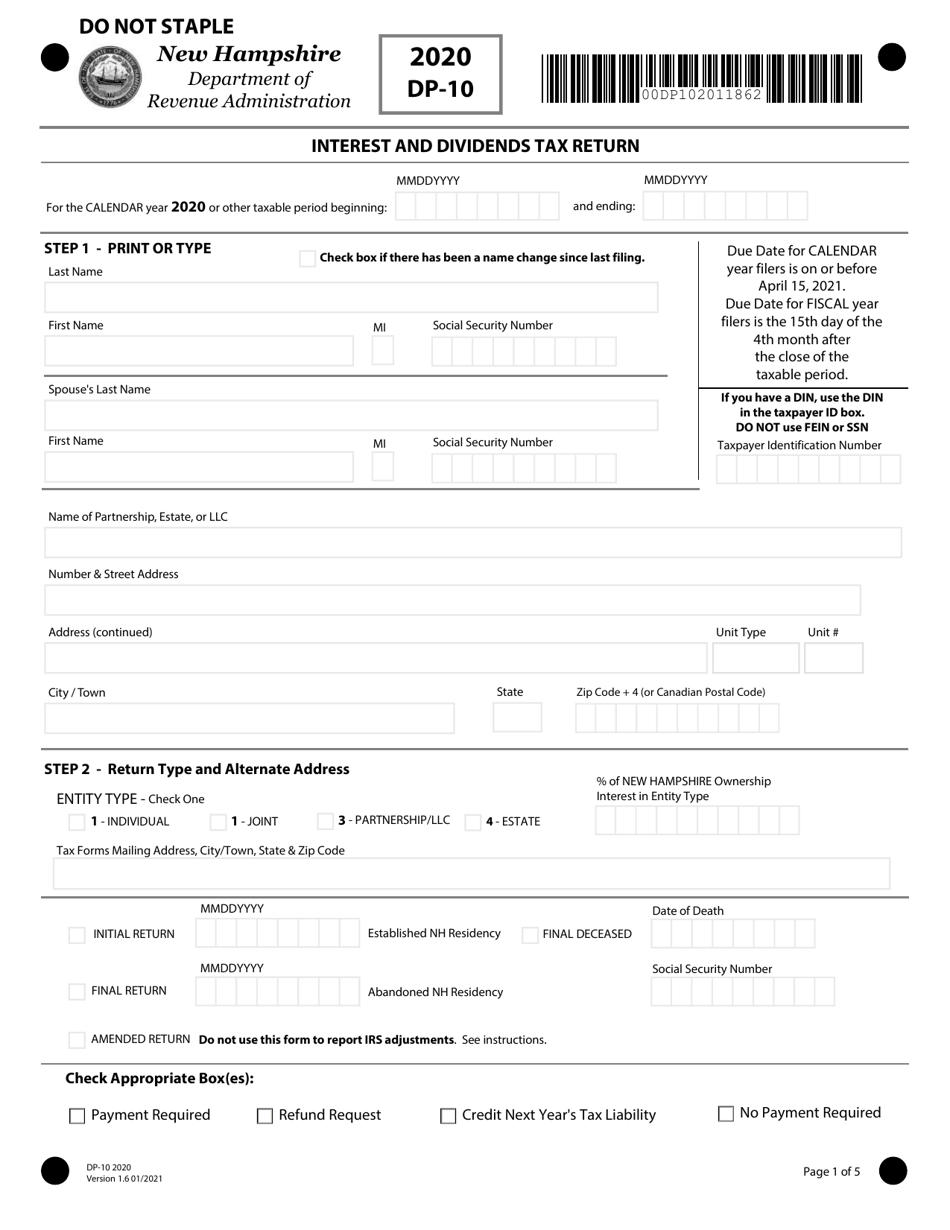

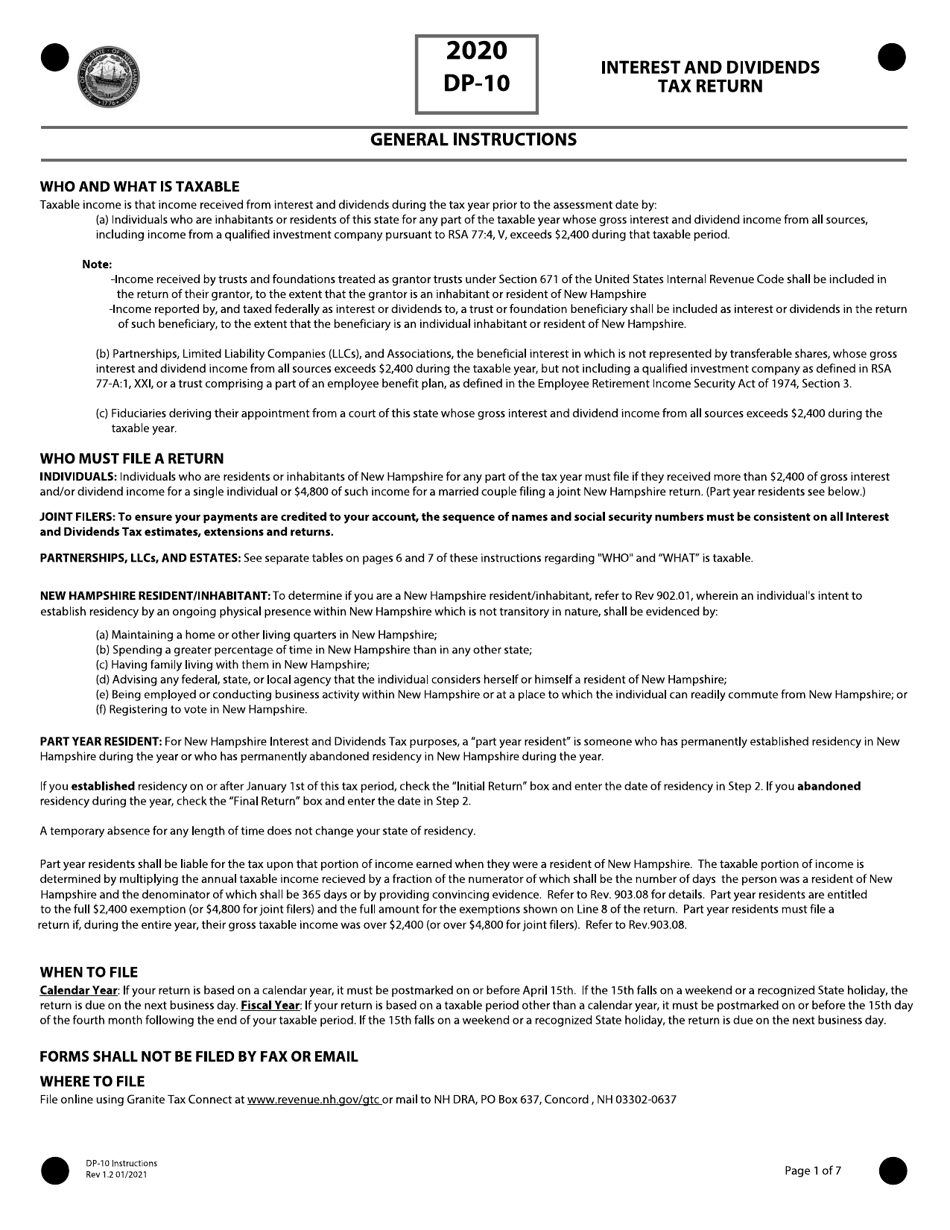

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

Usborne Books More Usborne Books Usborne Books

Popdust On Twitter Shake Shack Shake Shack Burger Shack Burger

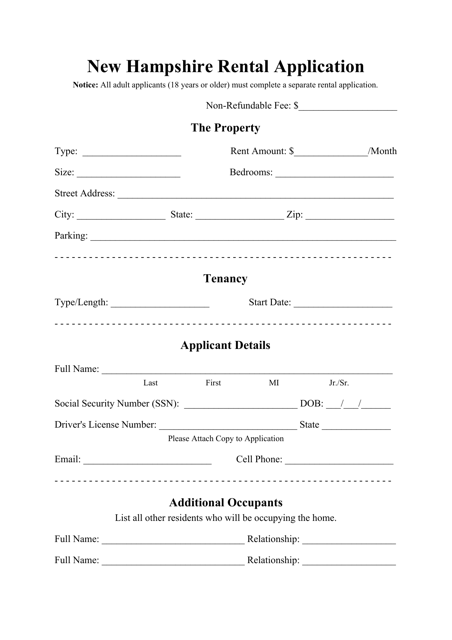

New Hampshire Rental Application Form Download Printable Pdf Templateroller

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

Get And Sign Nh Dor 2019 2022 Form

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

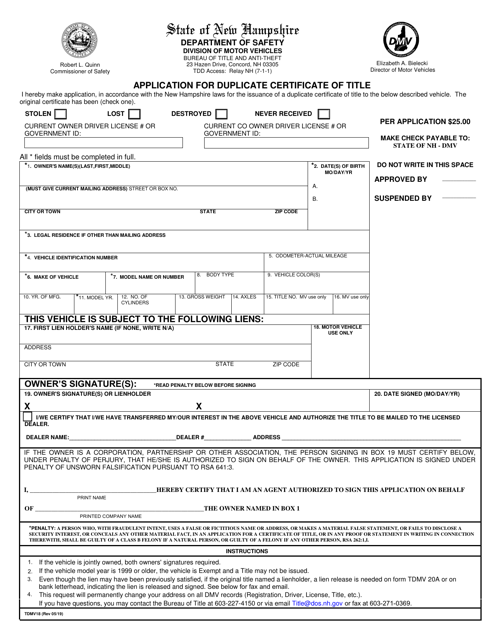

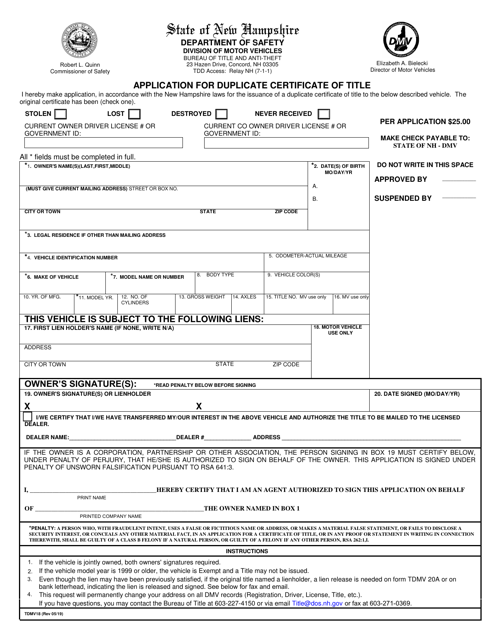

Form Tdmv18 Download Fillable Pdf Or Fill Online Application For Duplicate Certificate Of Title New Hampshire Templateroller

Barn Door Hostel And Campground Rumney New Hampshire White Mountains Rock Climbing Hostel Camping Nh Hostels Network

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Download Instructions For Form Dp 10 Interest And Dividends Tax Return Pdf 2020 Templateroller

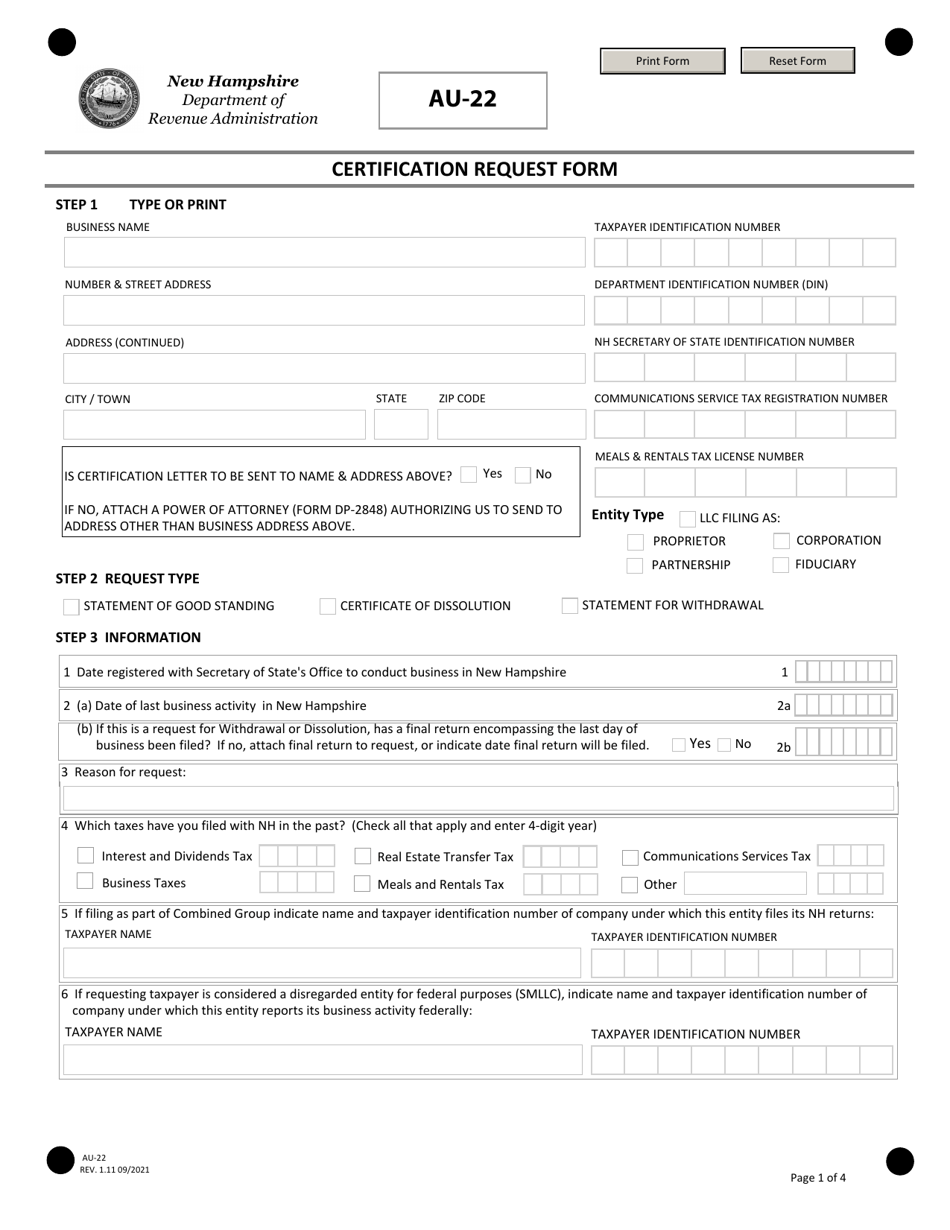

Form Au 22 Download Fillable Pdf Or Fill Online Certification Request Form New Hampshire Templateroller

Facilities Campground Crow S Nest Lake Sunapee

Business Expense Tracker Template Business Expense Tracker Expense Tracker Business Expense